|

Scooped by

Denise

August 19, 10:11 AM

|

Key Tourism Facts 2024 provides a collation of available key tourism performance data on: - Tourism Numbers

- Tourism Revenue

- Regional Performance

- Overseas Tourists

- Overseas Holidaymakers &

- Domestic Tourism

See the data in this fact card.

|

Scooped by

Denise

September 17, 11:20 AM

|

In the latest edition of the Tourism Barometer: - International tourist arrivals grew 5% in the first six months of 2025 (versus 2024, (1.5 billion arrivals) and +4% above 2019.

- 690 million tourists travelled internationally between Jan-June 2025, 33 million more than in the same period of 2024.

- Despite geopolitical and trade tensions, the first half of 2025 saw sustained travel demand globally, but results were mixed among regions.

- Europe welcomed nearly 340 million international tourists this first half of 2025, +4% more v 2024 and +7% more than 2019.

See more detail in this report.

|

Scooped by

Denise

June 10, 11:01 AM

|

- Summer seat capacity to ROI is expected to increase by 6.5% vs. Summer 2024, to 16.5K seats

- The share of seats from North America now accounts for 13% of all seats to ROI.

- Sea access to ROI is expected to be lower this Summer.

- 3.261 million passenger capacity is scheduled over the summer season, 88% is on Cross Channel routes.

- The decrease in capacity is due to the downsizing of vessels and some no longer operating on certain routes.

Read more in this report.

|

Scooped by

Denise

August 19, 10:46 AM

|

Key Tourism Facts provides tourism related data for Dublin in 2024 on: - Overseas tourists

- Domestic tourists

- Types of accommodation used

- Activities engaged in and

- Motivations to travel

See more data in the infographic.

|

Scooped by

Denise

August 19, 10:23 AM

|

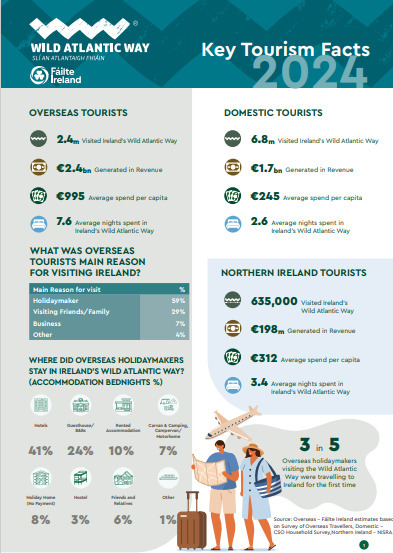

Key Tourism Facts provides tourism related data for the Wild Atlantic Way (WAW) in 2024 on: - Overseas tourists

- Domestic tourists

- Types of accommodation used

- Activities engaged in and

- Motivations to travel

See more data in the infographic.

|

Scooped by

Denise

June 25, 9:13 AM

|

Fáilte Ireland carried out a survey on the performance of the tourism industry in May 2025, some of the finding are listed below: - 26% of businesses have increased their revenue in 2025 and 23% are the same, and 51% say revenue decreased.

- Revenue is down for most sectors, B&Bs (74%), self catering (62%), food & drink (58%) and tour guides (56%).

- Most businesses (56%) say 2025 will be ahead of 2024 or on par with last year.

- Fall in revenue is due to lack of disposable income and affordable accommodation, & global economic uncertainty brought about by President Trump’s policies. 60% cite the Trump presidency as a concern.

See more in this report.

|

Scooped by

Denise

June 10, 11:55 AM

|

This report: - Assesses travel behaviour and seasonal trends for domestic travel in Ireland.

- Explores the macro factors impacting travel behaviour and the regional and seasonal nuances of travel.

- Reviews winter travel performance with key focus on satisfaction and value for money.

- Explores medium and short term travel opportunities and looks at what are the emerging trends that can be leveraged to promote travel, seasonality, regionality and sustainable travel.

- Looks at the impact the cost of living may have on short term domestic travel.

See more in the full report.

|

Scooped by

Denise

April 10, 7:09 AM

|

As 2024 came to a close, findings of the December hotel report were: - on average hoteliers experienced the 2nd lowest occupancy recorded this year at 59.7% down 1.3% compared to last year.

- The lowest room occupancy (56.9%) was recorded in January 2024. Whilst occupancy declined, ADR increased a modest 1.2%, but not enough to hold RevPAR positive (-0.4%).

- Bedspace occupancy declined at an even greater rate than room occupancy indicating a shift in guest mix to a more business-oriented traveller.

- Counties generally followed national trends with most counties posting room and bedspace occupancy declines, and modest ADR increases.

- December performance by grade was mixed with 5-Star hotels posting strong gains while 4-Star hotels were generally flat and both occupancy and ADR declined in 3-star hotels.

See more in the full report.

|

Scooped by

Denise

July 17, 2024 5:31 AM

|

The Travel & Tourism Development Index (TTDI) 2024 reflects the Travel & Tourism sector’s recovery from the COVID-19 pandemic and the ongoing and future challenges affecting the enabling conditions for its growth. The index provides a strategic benchmarking tool for business, governments, international organizations and others to develop the Travel & Tourism sector. The TTDI seeks to inform policy-makers, companies and related stakeholders by providing insights into Travel & Tourism economies’ strengths and areas for improvement, and by examining the interdependent nature of the internal and external factors driving this complex sector. See more in this report.

|

Scooped by

Denise

May 14, 2024 10:23 AM

|

Results from the Accommodation Occupancy Survey for 2023 found: - Occupancy rates in every sector were above 2022 levels.

- Guesthouse room occupancy (77%) exceeded 2022 (68%)

- B&B room occupancy (64%) in 2023 was well above 2022 (54%) – but many B&Bs have not reopened.

- Self-catering unit occupancy was 62% in 2023 (compared to 58% in 2022) – this sector recovered faster than others after Covid and so there was less ‘headroom’ to improve significantly on an already good 2022.

- Caravan and campsite pitch occupancy Apr – Sep was 60%, which compares to 56% in 2022 – the poor summer weather did have an impact.

- Hostel bed occupancy (65%) in 2023 was also up on 2022 (59%)

- International tourists underpin the growth in 2023.

See more in the full report.

|

|

Scooped by

Denise

September 19, 7:03 AM

|

In the September edition of the Dublin Economic Monitor results for Q2 2025 were: - Employment in Dublin reached a new high of 837,700 residents employed in Q2 2025.

- Dublin retail spending rose 0.7%.

- Dublin business activity rose in despite a slowdown in overall growth.

- Passenger journeys on Dublin’s public transport network

increased to 71.6 million reflecting an additional 1.65 million trips. - Dublin hotel occupancy hit its strongest early-summer levels since Covid-19, peaking at a rate of 91.1% in June 2025.

See more in the full report.

|

Scooped by

Denise

September 17, 10:38 AM

|

In the September report: - Air capacity to the island of Ireland (IOI) for 2025 summer season is scheduled at +4% ahead of the same period last year. (OAG).

- Indicators for the winter are positive. Planned seat capacity to the (IOI) are up +12% on last winter.

- CSO reports - 3.47 million visitors to ROI (Jan- July), spending €2.86 billion. This represents a softening in visitor arrivals and spend v 2024.

- Average hotel occupancy levels on the (IOI) for the first seven months of 2025 were on par with last year.

See more data in the full report.

|

Scooped by

Denise

August 19, 10:54 AM

|

Key Tourism Facts provides tourism related data for Ireland's Hidden Heartlands (IHH) in 2024 on: - Overseas tourists

- Domestic tourists

- Types of accommodation used

- Activities engaged in and

- Motivations to travel

See more data in the infographic.

|

Scooped by

Denise

August 19, 10:30 AM

|

Key Tourism Facts provides tourism related data for Ireland's Ancient East (IAE) in 2024 on: - Overseas tourists

- Domestic tourists

- Types of accommodation used

- Activities engaged in and

- Motivations to travel

See more data in the infographic.

|

Scooped by

Denise

July 30, 11:56 AM

|

This report is a collaboration between Amadeus and UN Tourism and examines air travel, hospitality, and key destination trends, with projections from May 2024 to October 2025. - Europe’s tourism success now depends on its ability to adapt quickly, act collaboratively, and invest wisely.

- Th report covers key trends providing valuable insights based on destination searches, airline bookings and hotel occupancy rates.

- This report aims to serve as a practical roadmap for the future of European travel.

See more in the full report.

|

Scooped by

Denise

June 10, 11:26 AM

|

Key results in this report were: - International tourist arrivals grew 5% in January-March 2025. Over 300 million tourists travelled internationally in Q1 2025, up 14 million for the same period in 2024.

- The start of 2025 saw robust travel demand, though results were mixed among regions. Africa was up (+9%) while the Americas & Europe were (+2%) the Middle East (+1%).

- Asia and the Pacific (+13%) continued to rebound strongly. .

- Visitor spending was strong with many destinations reporting solid growth in earnings.

- Economic and geopolitical issues continue to pose

risks to the sustained performance of tourism and traveller confidence but despite this travel demand is expected to remain resilient.

|

Scooped by

Denise

June 10, 10:56 AM

|

In the latest Trends and Prospect report for Q1 2025 key findings are: - International tourist arrivals to Europe rose 4.9% in Q1 2025 compared to the same period last year.

- Value-for-money and off-peak travel trends continue to drive demand amid increasing economic pressures.

- New US tariffs expected to pose challenges for transatlantic travel and global tourism performance.

- Rising prices, persistent geopolitical tensions, and the introduction of new US tariffs are expected to influence traveller sentiment and spending habits as the year progresses.

- The latest estimate for 2025 suggests that travellers are expected to spend around 14% more across Europe than in 2024.

See more in the full report.

|

Scooped by

Denise

December 12, 2024 6:10 AM

|

The World Travel Market for 2024: - Global leisure tourism expenditure in 2024 is 24% above 2019 values now worth over $5.5 trillion.

- International travel is expected to be a key growth driver, In 2024, 1.5 billion international tourism arrivals is expected, but this figure should grow by over 30% to 2 billion in 2030.

- Western European countries and the United States will continue to be the largest outbound travel markets but emerging markets will post the fastest growth, i.e. China.

- Short-haul travel will dominate, as households face increased financial pressures and are becoming more cost� conscious but they will continue to prioritise travel.

- Average length of stay on international travel remains elevated as shorter trips are being sacrificed in place of longer visits. This is to explore destinations more fully as part of the slow travel trend.

See more in the full report.

|

Scooped by

Denise

July 10, 2024 10:04 AM

|

The Central Statistics Office (CSO) provides data based on the annual results of their Household Travel Survey (HTS). Fáilte Ireland then generates expenditure estimates based on the results of the HTS (in this case Q4 and for the year 2023). This report provides a breakdown of trips, nights, average length of stay and spend by Irish residents by main county visited. Some of the findings are: - Irish residents took 14.3 million domestic trips in 2023,

- They spent a total of €3.1 billion.

- They stayed an average of 2.4 nights per trip, a total 34 million nights.

See more results by county.

|

Your new post is loading...

Your new post is loading...